how are rsus taxed when sold

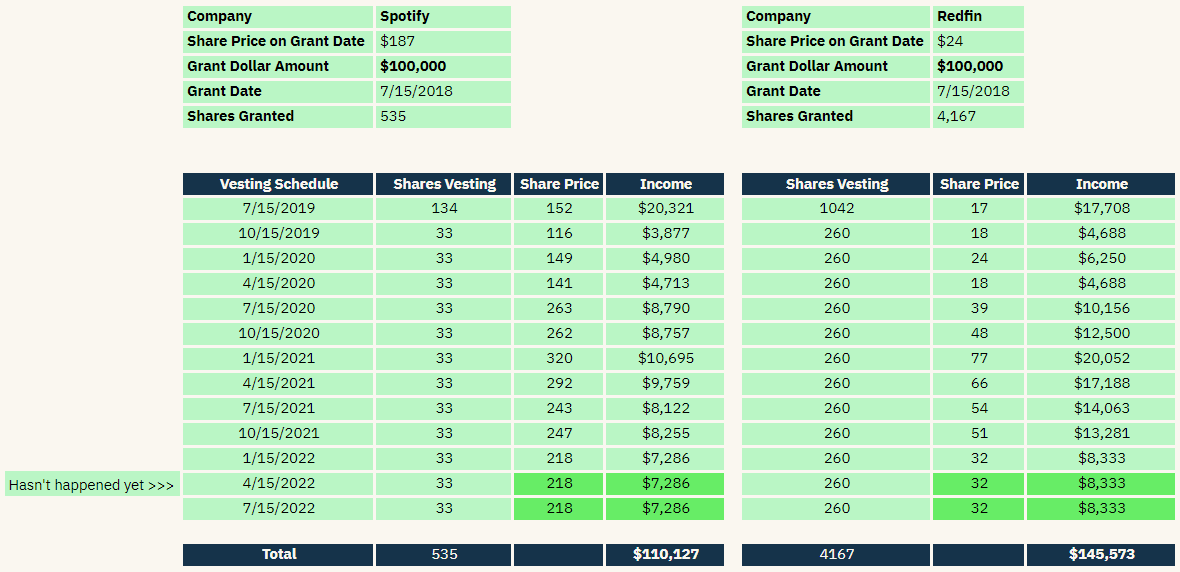

The tax implications in years three and four often surprise Amazon employees. March 17 2020 936 AM.

Why Rsus Are Edging Out Restricted Stock Cfo

This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers.

. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. The total of all four years is 432000. Long-term capital gains tax on gain if held for 1 year past vesting.

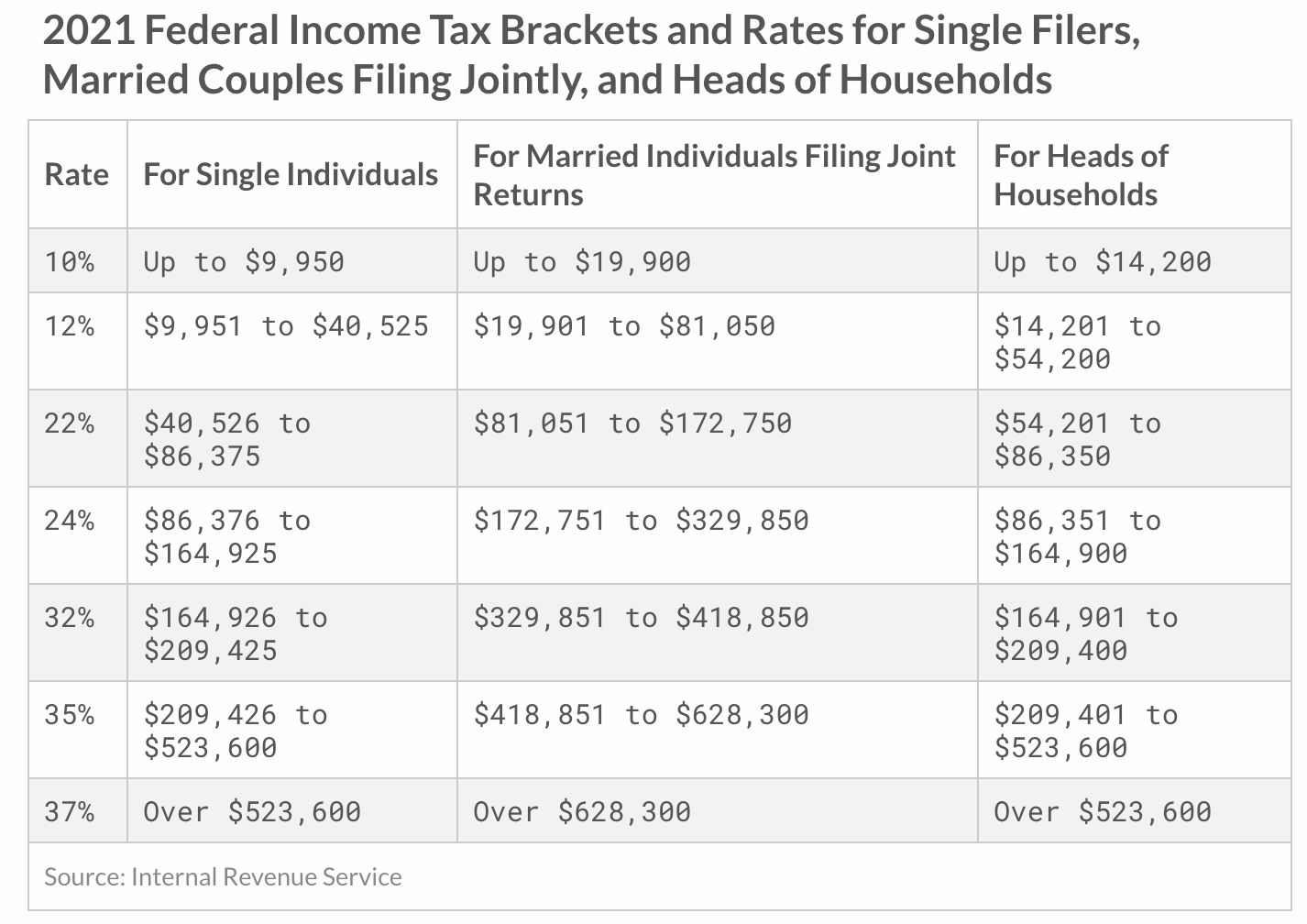

Social Security Tax - 62 up to 142800 then. LTCG are taxes on stock you sell after owning it for 365 days or. The four taxes youll owe when you receive a paycheck or when an RSU vests include.

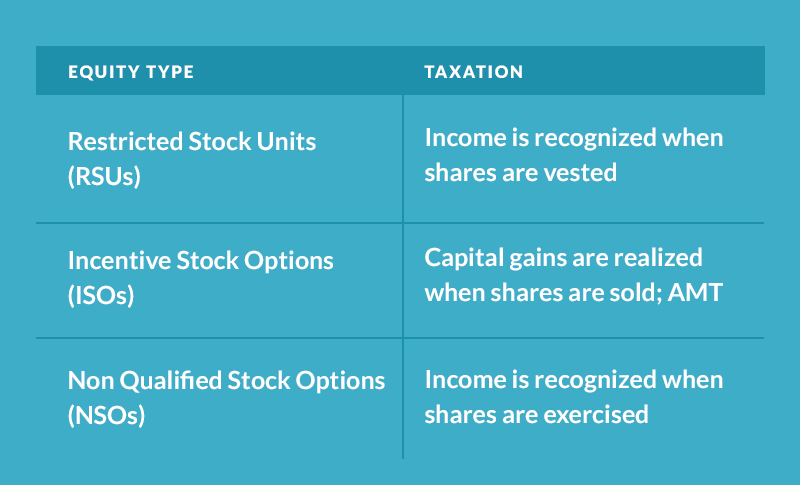

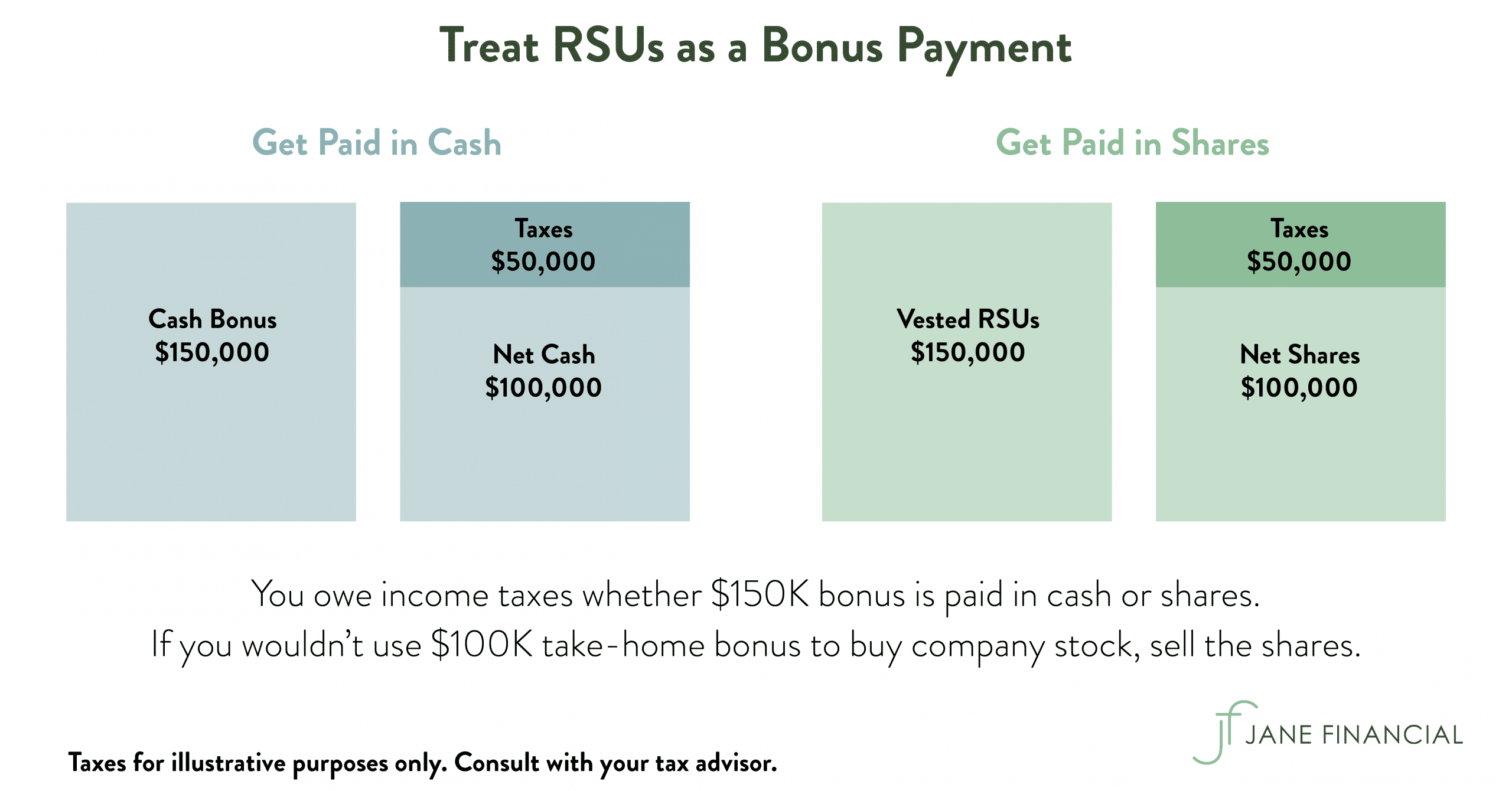

RSUs are taxed as income to you when they vest. When RSUs are issued to an employee or executive they are subject to ordinary income tax. RSUs and Taxes.

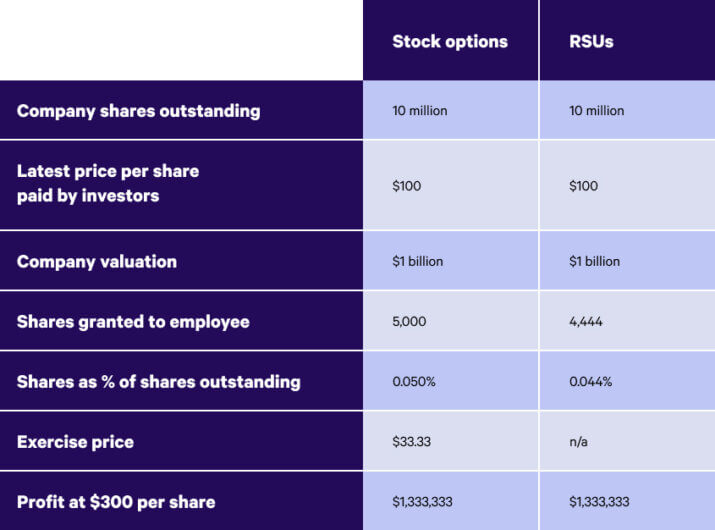

This is a myth because stock options are only taxed when they are exercised. RSUs are taxed when they vest. Corporations normally withhold 22 of RSU vesting which may not be enough if the amount is large.

Ordinary tax on current share value. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. The only time capital gains tax comes into play is when the recipient of the RSUs choose to not sell the stock immediately and it appreciates in value before selling it.

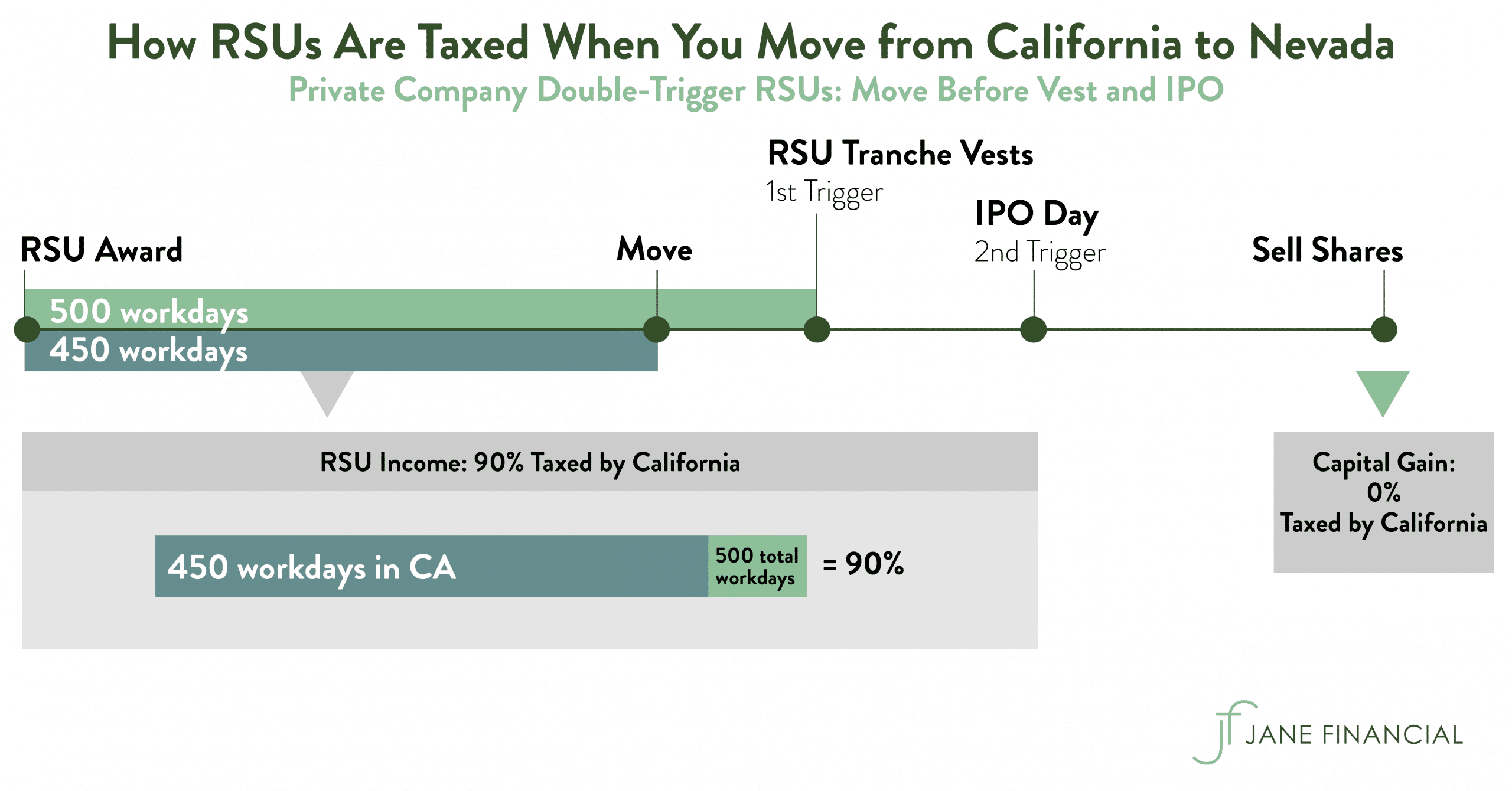

The amount will be based on. Here is how RSUs are taxed. Amazon RSUs vest at 5 -15 -40 -40 not the usual 25-25-25-25.

Each increment is subject to tax on the vesting date as compensation income when the shares are delivered. Also restricted stock units are subject. May be taxed as ordinary income when exercised or as long-term capital gains depending on when sold.

If you sell your shares immediately there is no capital gain tax and you only pay ordinary income. Federal Income Tax - Varies based on income. Employees are taxed when RSUs vest and shares are distributed.

As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs. If you received a 1099-B you have to report the sale. Heres the tax summary for RSUs.

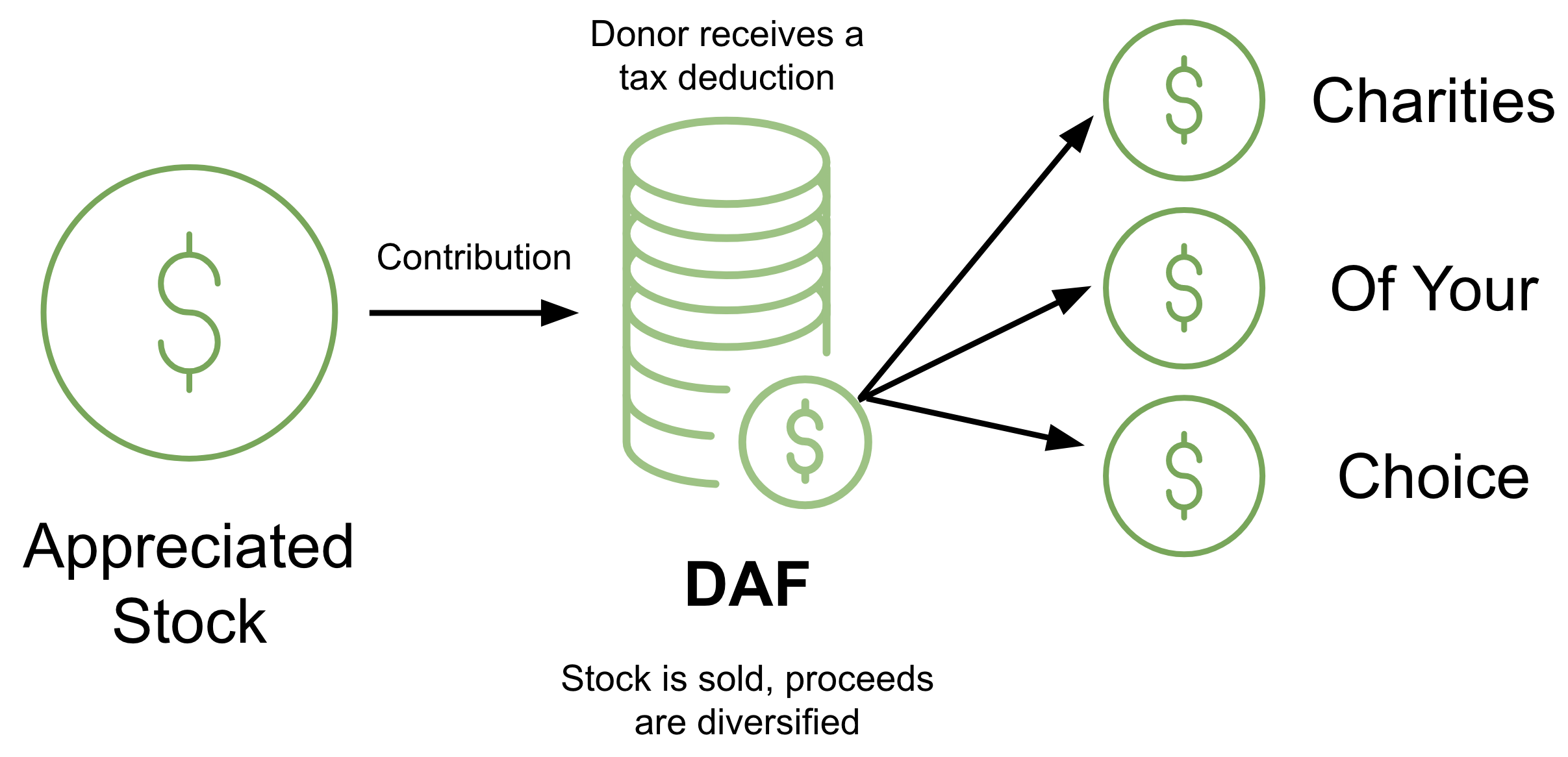

Income is reported on the W-2 and shares are withheld to cover tax. You can choose to sell the RSUs. Capital gains taxes come in two forms.

Long Term Capital Gains LTCG and Short Term Capital Gains STCG. Capital gains tax only applies if the recipient of RSUs does not sell the stock. There is a separate capital gains tax that youll owe when you actually sell the stock award too assuming you sell at a gain.

With an all-in tax rate of 15 you only need to pay. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. Taxes When You Sell RSUs.

Common Rsu Misconceptions Brooklyn Fi

Rsus Vs Stock Options What S The Difference Wealthfront

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic Tax

:max_bytes(150000):strip_icc()/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

How Are My Restricted Stock Units Taxed Trailhead Planners

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

What Is A Restricted Stock Unit Rsu And How Is It Taxed

How To Avoid Taxes On Rsus Equity Ftw

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Restricted Stock Units The Basics Taxes Youtube

Sell Your Rsus As Soon As They Vest

Tax Planning For Stock Options

Restricted Stock Units Jane Financial

Restricted Stock Rsus Taxes And Key Decisions Youtube

Should I Hold Or Sell My Rsus Sofi